Using the Blockchain to Estimate UpDown's Profitability

UpDown is a popular Bitcoin binary options platform. A player can take either an "up" or "down" position on the price of an asset (e.g. gold or oil), a currency-pair (e.g. EUR/USD) or even something more esoteric (e.g. a random walk) where the resulting payout is either some multiple of the amount wagered or nothing. For example, UpDown offers a gold market. If you believe the price of gold will increase in the next sixty seconds, you can make a bet by sending bitcoins to the address specifically for the Gold Up market. If you are correct, you will receive 1.75 times the amount you wagered, otherwise you receive nothing.

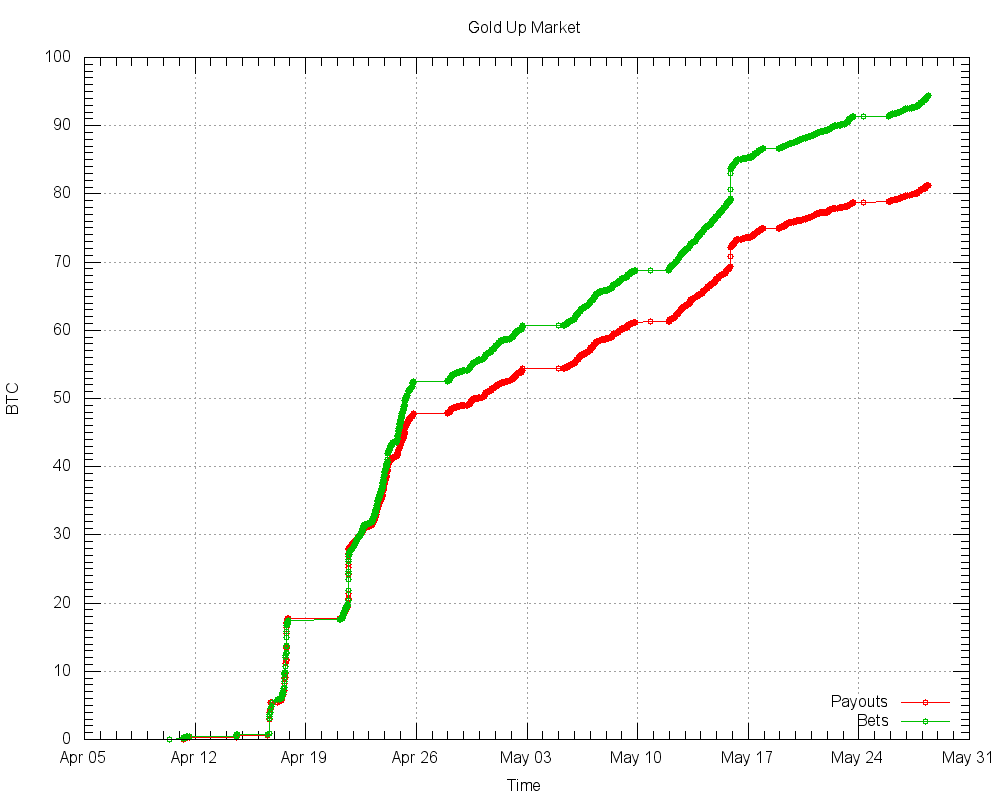

Every bet and payout is recorded on the blockchain. For each market, we can identify the vast majority of relevant bets and payouts and plot their cumulative value in bitcoins over time. The following is one such plot for the Gold Up market from its opening in mid-April 2014 to the end of May 2014:

For the period shown, we estimate that UpDown received 3,536 bets on the Gold Up market. The total amount wagered was 94.36 BTC. UpDown paid out 81.27 BTC in winnings and was left with a profit of 13.09 BTC. This does not include operating costs. We can see from the plot that the market was profitable from inception. We can also observe that this market was closed at weekends.

We can repeat the exercise for each market. The results are summarised in the tables below. You can click on any of the market names to see a similar plot to the one above.

| Asset Markets | # Bets | Wagered (BTC) | Payouts (BTC) | Profit (BTC) |

| Gold Up | 3,536 | 94.35768169 | 81.27439612 | 13.08328557 |

| Gold Down | 3,420 | 87.95203982 | 74.95382596 | 12.99821386 |

| Silver Up | 3,215 | 104.04224196 | 87.70476703 | 16.33747493 |

| Silver Down | 3,054 | 79.77713535 | 68.57847705 | 11.19865830 |

| Oil Up | 586 | 14.80848748 | 14.31758509 | 0.49090239 |

| Oil Down | 442 | 12.33853876 | 10.35946225 | 1.97907651 |

| Currency-Pair Markets | # Bets | Wagered (BTC) | Payouts (BTC) | Profit (BTC) |

| EUR/USD Up | 3,293 | 98.45726087 | 85.94384575 | 12.51341512 |

| EUR/USD Down | 2,970 | 63.16867601 | 51.72954467 | 11.43913134 |

| GBP/USD Up | 3,010 | 57.11467860 | 46.81658901 | 10.29808959 |

| GBP/USD Down | 2,844 | 54.40708202 | 46.39458244 | 8.01249958 |

| USD/CHF Up | 2,764 | 51.71120343 | 39.91836947 | 11.79283396 |

| USD/CHF Down | 2,805 | 51.61590052 | 41.01838617 | 10.59751435 |

| AUD/USD Up | 2,921 | 53.83228691 | 42.48009601 | 11.35219090 |

| AUD/USD Down | 9,790 | 190.67501382 | 165.10146280 | 25.57355102 |

| JPY/USD Up | 2,874 | 55.25482414 | 45.49762326 | 9.75720088 |

| JPY/USD Down | 3,063 | 59.17775206 | 49.40593911 | 9.77181295 |

| NZD/USD Up | 2,703 | 50.23935205 | 41.10382731 | 9.13552474 |

| NZD/USD Down | 2,732 | 51.48715990 | 43.84757781 | 7.63958209 |

| Novelty Markets | # Bets | Wagered (BTC) | Payouts (BTC) | Profit (BTC) |

| Planes in the Air Up | 1,459 | 68.10460676 | 53.39359623 | 14.71101053 |

| Planes in the Air Down | 3,909 | 87.62287060 | 60.82408107 | 26.79878953 |

| White Noise Up | 4,279 | 87.52495407 | 74.89993607 | 12.62501800 |

| White Noise Down | 4,363 | 88.96360352 | 77.79944896 | 11.16415456 |

| Random Walk Up | 4,594 | 109.58409857 | 94.64430783 | 14.93979074 |

| Random Walk Down | 4,339 | 87.07268781 | 77.61538650 | 9.45730131 |

In total, we estimate that UpDown received 78,965 bets from mid-April 2014 to the end of May 2014. Players wagered 1,759.28 BTC and UpDown paid out 1,474.57 BTC in winnings. This leaves a profit of 284.81 BTC before operating expenses. This is an estimate based entirely on publicly available information: the addresses are shown on UpDown's website along with enough information to identify payouts and the transactions are all available on the blockchain.

This is a sample analysis. It can be extended to the present day. However, the available markets, the payout multiples and the addresses occasionally change. There is also evidence of double-spending attacks against UpDown's service which require more careful analysis. It is possible to extend this analysis in many other ways, for example, to estimate the number of repeat players, identify lucky and unlucky streaks, or identify martingales.

A Note on Financial Privacy

The blockchain is, in many ways, a double-edged sword for financial privacy. It allows us to conduct a financial transaction with anyone else in the world without the need to divulge identifying information to an intermediary. However, it does require that we broadcast the transaction to the world. The contents of the transaction, its relationship with other transactions, and the act of broadcasting the transaction itself combine to muddy the issue.